Leaked document shows W.Va. Republicans considering tax raise to offset income tax cut

Email shows list of proposed measures to fill $2.1 billion hole created by removal of personal income tax. Experts say even with tax increase, the plan is still $500 million short.

Feb. 2, 2021 • Written by Kyle Vass; Edited by Lacey Johnson

HUNTINGTON, W.Va. (Dragline)—W.Va. House Majority Whip Paul Espinosa sent a survey asking Republican delegates to indicate their support for proposed measures to scrap personal income tax in the state, according to a leaked email sent to Dragline.

House Majority Whip Paul Espinosa (R) sent out an email survey of measures that could be taken to offset the cost of losing the personal income tax in W.Va January 2021. (Photo/West Virginia Legislature)

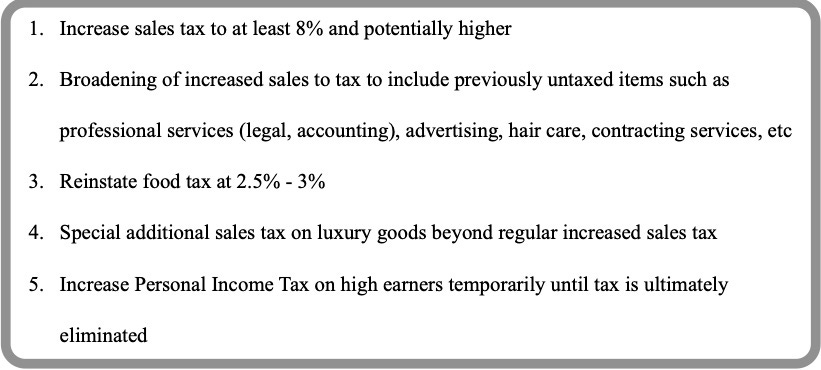

The top five measures (in the list of twelve) were proposed tax hikes and expansions.

Espinosa acknowledged in the email that the House will have to take “measures that are not politically popular” to “achieve the goal of eliminating of eliminating personal income tax.” The move appears to conflict with a "taxpayer protection" pledge signed by Espinosa and more than 20 Republicans in the W.Va. House of Delegates that “commits an elected official or candidate for public office to oppose any efforts to increase taxes.”

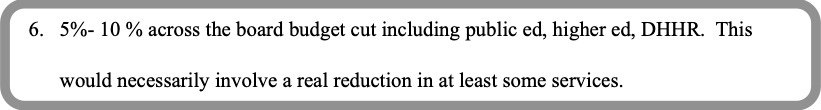

In addition to proposed tax raises, the survey sent out includes a 5%-10% budget cut to organizations such as the state’s Department of Health and Human Resources. The DHHR oversees various state programs including Child Protective Services, Behavioral Health Services for people suffering from Substance Use Disorder and Medicaid. As of 2020, 29% of West Virginians were enrolled in Medicaid, the highest percentage of any state. According to the document, such budget cuts would “necessarily involve a real reduction in at least some services.”

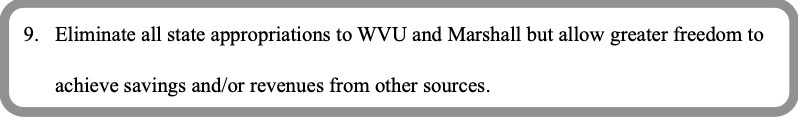

Other budget cuts on the list include the elimination of the Promise Scholarship which offers to tuition assistance to high school students who choose to stay in West Virginia for school. Also, on the list is a proposal to eliminate all funding to Marshall University and West Virginia University.

Sean O’Leary is the senior analyst for the West Virginia Center on Budget and Policy in Charleston, W.Va. (Photo/West Virginia Center for Budget and Policy)

According to Sean O’Leary with the West Virginia Center on Budget and Policy, budget cuts to public education have already been shown to be economically disastrous in West Virginia. O’Leary said between 2013 and 2020, state funding for higher education fell by 13%. He said this caused a 33% increase in tuition to offset the decrease in funding and enrollment fell by 6%. “And while those tax cuts were hailed at the time, as the ‘most pro-growth’ tax reform in the country, WV has had the worst job growth [out of all states in the US] since their enactment.”

According the U.S. Bureau of Statistics, West Virginia ranked last in the nation for job growth in 2019. (Chart/Statista)

O’Leary said that even if Republicans raised the sales tax to 10 percent (higher than any state in the nation) and made all of the cuts on this list, the budget would still come up short by about $500 million with the removal of the personal income tax. He added that despite the framing that removing the personal income tax will decrease taxes, it simply shifts the burden away from the wealthiest earners in the state. “This isn't a surprise, this is what the tax systems in states without income taxes look like. They are not low tax states, they are low tax states for the wealthy. Low and middle income families, who pay more of their income in sales taxes, would likely see an overall tax increase with this plan. Past proposals from the governor and legislators to eliminate the income tax and replace it with a variety of sales tax increases all shared this flaw.”

Dragline reached out to Espinosa for comment but did not receive a response.